When we first moved to the Sunshine State, we expected the warm weather and sunny days. We figured that going solar might be a good option. What we didn’t expect was — knock knock knock — that friendly neighborhood solar salesperson. Again.

We could get a tax credit if we buy the system, so we hear. It can slash, if not eliminate our power bill, we are told. If we aren’t ready for that big outlay, we can finance the setup. We can even just lease a system that’s installed on our roof through something called a PPA.

Seems like a no-brainer! But looking into this further, things are quite a lot cloudier.

Google’s Project Sunroof is a decent way to get some back of the napkin estimates on what systems might work for our setup and approximately what the financials should look like. Things would of course vary a bit if we attempted to go through with this, but this gets us into the ballpark.

In our case a 9KW system should cover about 75–80% of our electricity needs.

Buying a system outright

Let’s assume I have a bunch of cash lying around that I don’t know what to do with. What if I just buy a system outright?

Let’s plug our number into Google’s Project Sunroof, and select the ‘Buy’ tab. This will show us some useful numbers. On the far left we show the total cost to us outright. This will be the cost of the system minus any tax credits we get. The second number is how much electricity we saved by going solar, minus any electricity costs we still may have from our utility.

The important number though is on the far right. This shows us how much we save, total, over 20 years, minus how much we spent to get the system in the first place. Let’s see the results:

Fifteen years until payback — not exactly money in my pocket anytime soon, but I should save nine thousand dollars in twenty years. That’s nothing to sneeze at.

Another way to look at the savings above is that without solar we would have spent $36K in electricity over 20 years buying from our utility company. By installing solar panels, we have upfront costs of $22K, but a lower amount we have to purchase from the electrical company over the years. This brings our total 20-year costs with solar panels to about $27K.

$22,000 is a lot of money to have just laying around, so how can I get these solar savings without such a large upfront cost and still reduce how much we spend over 20 years?

Financing a system

Financing a system is just what it sounds like. You take out a loan to buy a solar system. Sounds good — we get our system at a low or zero up front cost and can begin saving money right away.

The ‘LOAN’ tab lays out the numbers a bit differently. We should see an upfront cost on the left of $0, since we aren’t paying anything out of pocket. In the middle we should see how much we can expect to save every year. This should be the difference between our current power bill and the monthly payment on the loan over a single year. Adding this up over 20 years we should see how much we save over the lifespan of the system on the right.

Let’s click the ‘LOAN’ tab and see what we get:

Yikes, look at those big red numbers. A $400 a year cost for setting up solar with a loan and a 20 year cost of $9K. Essentially spend $45K over 20 years, much more than the $36K not having solar at all. This scenario will lose us significant money over time.

We should be in a pretty ideal position for solar — in a state with a lot of sunny days, directly south facing roof, no obstructions — and we still cannot make the math work on a solar loan.

Leasing a system or a PPA

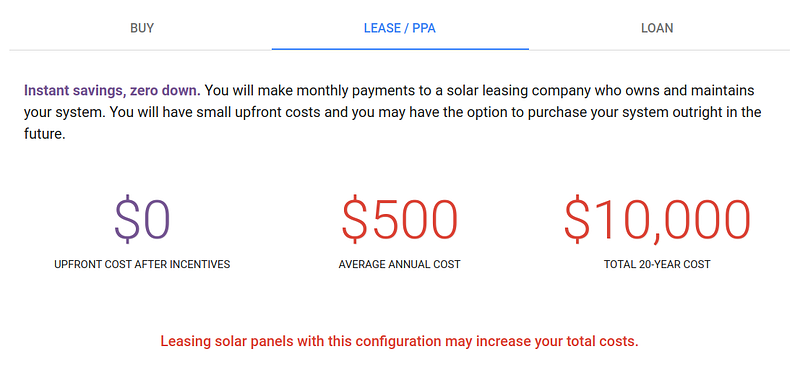

The final method to get a system setup is with a lease, or a power purchase agreement (PPA). With this scheme, a company sets up their panels on your roof. Since the company setting this up owns the panels, they keep any tax incentives. You sign a long term agreement to purchase power through this company instead of through your standard power company. You often have the opportunity to buy the system outright from the company down the road if you feel inclined.

There are a number of problems with this arrangement. These companies will set their own rate increase over time. In order to justify the ‘savings’ with these systems, they will compare rate increases from the power company at unrealistic increases. Over time the homeowner will not be the winner of this arrangement.

The layout for the lease/PPA is similar to the loan tab. We should see a $0 for upfront costs on the left, yearly savings in the middle, and savings over the 20 year span on the left. Clicking on ‘LEASE/PPA’ we see about what we expect:

We lose even more money than the solar loan. But in reality, It’s actually a bit worse than just the raw numbers.

A solar lease or PPA can create quite a conundrum when selling a house. You now have a very long term agreement that can result in a lien on your property. How many of us plan to stay in the same home for over 20 years?

The sales tactics suggest that the new homeowners will just take over the lease or PPA when you try to sell. I guarantee that if I’m buying a property, I will not enter into any such agreement. I suspect you will see a lot of homeowners with solar PPAs buying out the expensive contracts outright in order to sell their house. Here’s one such tale.

Opportunity Costs

We have identified two ways where it doesn’t make financial sense to setup solar panels. But, it does look like there could be real savings with buying a system outright.

If we did theoretically have $22K sitting around the house, though, would we really just keep it in the pantry for 20 years? Since solar is sold, in part, as a long-term investment, let’s compare it with some other long-term investments.

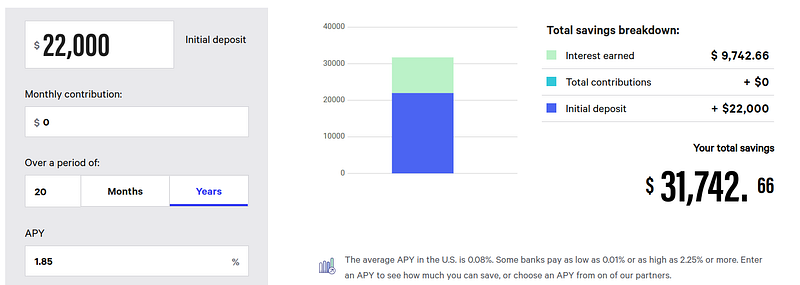

We could simply put the same amount of money we would spend on a solar system into a CD or money market account earning an interest rate of 1.85% for 20 years. We end up with the following:

This is showing us that our $22K investment grows to about $32K over 20 years. We have gained $10K over our initial investment just by saving our money and forgetting about it. We can then simply reduce our non solar electrical costs of $36K over 20 years by the $10K we earned and end up with a 20 year cost of $26K by investing rather than buying panels.

Our costs for 20 years of solar was $27K, but our simple investment beats it by $1K. It’s close, but solar looks less like a sure bet.

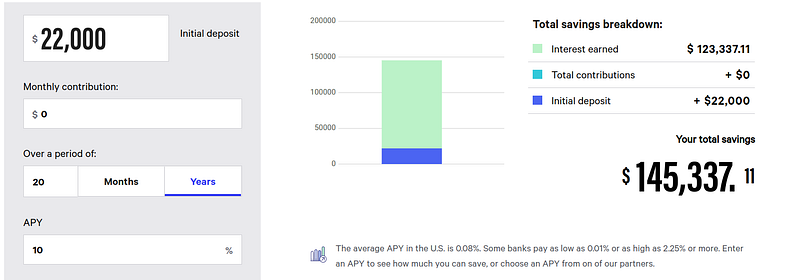

But here’s the thing: you typically would not invest in a money market or CD for such a long time frame. Historically, the S&P 500 averages about 10% per year. So if we simply bought a low cost S&P 500 index fund, this is what we should end up with:

We end up earning $123K over 20 years in interest alone! That not only offsets our entire electrical spend over that time period, but pays us back several times over.

This is the real opportunity cost when looking at solar as a long term investment. Not only am I earning far more back, but I have the added benefit of being able to take this account with me where I move, without major hassle, and with little ongoing maintenance.

More Hidden Costs

There are other costs that are not often included in solar estimates. In order to maintain a system a peak efficiency, you have to clean solar panels on a regular basis. In my above examples I would need to budget for about $700 per year for cleaning, or $21K over the life of the system.

That brings our 20 year total from buying a solar system from a savings of $9K to a loss of $12K.

There are a few more additional hidden costs of solar to consider:

- Panels degrade over time. You lose about 2% the first year and between 0.5% and 1% efficiency every following year.

- The typical homeowner is in a house for about 13 years. Even our best-case scenario had a break-even time of 15 years.

- 20+ year warranties from companies that have only been around for a few years should not be counted on. You may very well end up paying for repairs outright in 12 years.

- Solar panels add significant costs to any roofing project.

- Solar panel technology will only get better over time. Your 2020 system may depreciate faster than you think.

- Peak sunlight hours imply a south facing roof line with no obstructions. If your house is not arranged in this way, your system will be even less efficient.

- They are kind of ugly. Sure, that’s subjective, but it may steer away some potential buyers when it comes time to sell. This may be compounded by solar systems in a few years looking more like traditional roofs.

When Solar Still Might Makes Sense

If going green is very important to you, the financial considerations may not be the deciding factor. Your decisions do not need to be completely around what makes the most financial sense over time. I would still encourage you to buy a system outright.

Since a large portion of a solar install is the install portion, there can be an economy of scale when installing solar panels in commercial installations. The hassle and danger of contractors working on numerous residential properties can largely be avoided. If the cost per watt becomes closer to $1, things can make a lot more financial sense. Commercial installations also likely have a longer time horizon than a typical homeowner.

We are also beginning to see more utilities expand power capacity with solar arrays and other renewable energy sources. In fact, my local utility has scrapped plans for a more traditional energy plant to invest in a large solar install. We can go green indirectly by encouraging this even more.

Also, we can expect the technology to get better over time, both with panel cost and also with how they look and integrate into an existing roof.

Solar energy and renewable sources are a good thing. Tricking customers with confusing numbers, unrealistic promises, and pushy sales tactics, isn’t.

For now, I think I’ll keep things simple and invest in what I can move with me. Also, I may finally put out that ‘No Soliciting’ sign on the front porch.